Action Alert: Great News! “Repeal the Death Tax” bill introduced in the Legislature

Action Alert: Great News! “Repeal the Death Tax” bill introduced in the Legislature

Action Alert: Call Sen. Kelly Seyarto and Assemblyman Phillip Chen to thank them for co-authoring this important constitutional amendment.

HJTA is so pleased to announce that Senator Kelly Seyarto and Assemblyman Philip Chen have co-authored Senate Constitutional Amendment 4, which would restore the right of parents to transfer their home and a limited amount of other property to their children without reassessment to market value, and without any change to the property tax bill.

SCA 4 would fix Proposition 19, the 2020 ballot measure that took away those constitutional rights. SCA 4 also restores the right of grandparents to transfer the same property to grandchildren if the children’s parents are deceased.

These important rights were placed in the constitution by Proposition 58 in 1986, which was put on the ballot by a unanimous vote of the Legislature and passed with the approval of 75% of voters. In 1996, Proposition 193 extended the same rights to grandparents in some situations. But because of Proposition 19, these rights are gone. Now, with only limited exceptions, property is reassessed to current market value when transferred within families. This results in huge tax increases and often forces families to sell long-held properties, especially small apartment buildings, which accelerates gentrification and the loss of affordable housing.

SCA 4 would restore Propositions 58 and 193 to the constitution. HJTA is grateful to Sen. Seyarto and Assemblyman Chen for their willingness to step up and help California families hold on to the properties their parents worked so hard to acquire. Every community deserves the opportunity to build generational wealth.

Action Alert: Please call Sen. Seyarto and Assemblyman Chen to thank them for stepping up to protect California families from unaffordable tax increases.

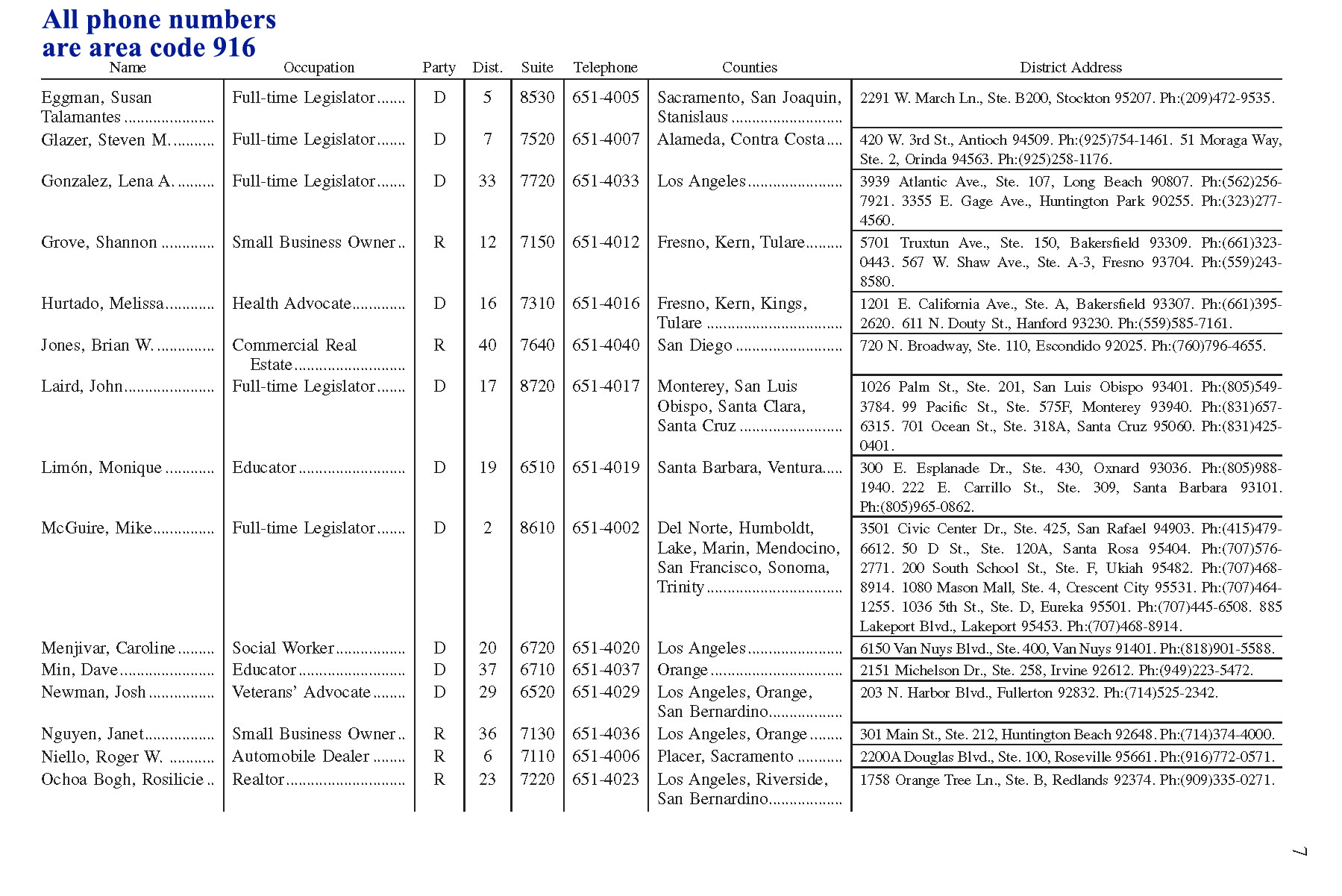

Sen. Kelly Seyarto – 916-651-4032

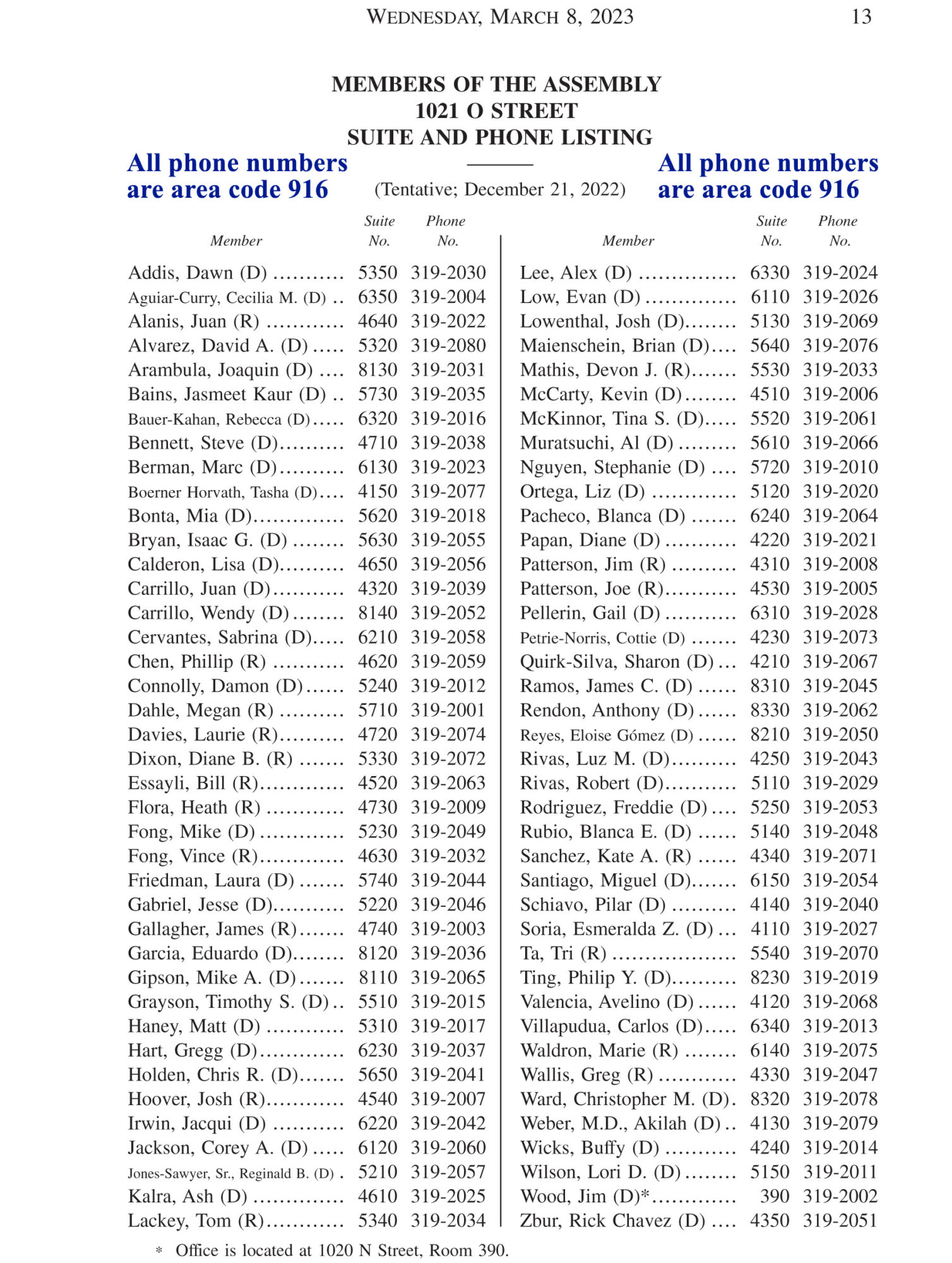

Assemblyman Phillip Chen – 916-319-2059

Please also call your state representatives in the Senate and Assembly and urge them to become co-authors of SCA 4. This bill is a major priority for the Howard Jarvis Taxpayers Association.

You can look up the names and contact information for your representatives at findyourrep.legislature.ca.gov or in the government pages of your local phone directory. Or find them at these links for the Senate and Assembly or on the lists below. Thank you!

Sincerely,

Jon Coupal

P.S. Here’s the complete phone directory for the Assembly and the Senate, for your reference.

Republishing this article with permission from HJTA – Howard Jarvis Taxpayers Association.